How to Prospect for Insurance

Life Insurance Prospecting Ideas

Prospecting for leads is a challenging activity in any industry, but insurance agents have it even harder. The field tends to be saturated in all but the smallest towns. With countless agents competing for business, finding quality leads that aren’t already spoken for becomes a painstaking, but critical process.

It can be done however, as every successful agent can attest. But it requires hard work, patience, perseverance, and the right strategies. We can’t help with the first three, but we can share a handful of proven tactics that help drive leads. So how do insurance agents get clients? Read on.

Use Company Supplied Leads, But Be Aware of Their Limitations

Many insurance companies will supply leads to their agents regularly. If you represent one of these, you should take advantage of this resource, particularly when your prospecting efforts are running dry.

However, company-supplied leads tend to be old and overworked. The reason is related to the high turnover rate present in the insurance industry. The insurance business is difficult, and the lion's share of new agents are unsuccessful, and when they quit, the leads they were given go back into the pool. It's not uncommon for leads to recycle from agent to agent multiple times.

New agents can get value from these leads since they’re free (except for the commission cut the company will take), but as you advance, you’ll want to develop your prospecting capabilities. The highest quality life insurance leads are found through other channels.

ALSO SEE: THE VALUE OF AUTOMATED THANK YOU CARDS IN BUSINESS

Network With Other Professionals

Another source for free leads is your extended professional network. Networking groups are one good way to build this valuable resource. They’ll often sponsor networking events, both in-person and virtual, as a way for professionals to get to know one another.

LinkedIn is another excellent way to build a web of professional contacts and get leads. You can establish yourself as an expert in your field by providing searchers a detailed profile, joining and participating in groups, offering advice and help to other users, and adding useful content that demonstrates your knowledge and professionalism.

As your network grows, the organic leads it delivers will increase, assuming you establish reciprocal relationships. As an example, imagine one of your clients is looking for a contractor. You pass on the name of someone you know in your professional circle. In turn, when one of their subcontractors quips offhandedly that she and her husband are in the market or life insurance, the contractor will pass on your name. You'll get insurance leads without any effort. Mortgage brokers are another great source to generate quality leads.

The better developed your network, the larger the referral pool. And assuming you treat your clients well, they will become a part of your extended network as well, passing your name on to friends and family. You can even add other agents to your pool list, particularly those that live in other states. Also real estate agents are happy to share their clients with the right referral.

Run Direct Mail Campaigns

The reports of direct mail’s death have been greatly exaggerated. Email marketing and other digital strategies have certainly taken its throne, but it can still quite effective.

The problem with advertising through snail mail is that recipients never read apparent advertisements. They go right from the mailbox to the garbage can. But this quick trip a postal graveyard can be interrupted by sending handwritten mailers.

Hand-addressed letters are rare in the modern world, so when one appears in someone’s mailbox, they open it. If they letter or card inside is also handwritten, they’ll read it. The assumption is that it’s either someone they know or something important enough to warrant handwriting. The open rate on handwritten mailers is much higher than for standard direct mail.

However, you're an insurance agent running an insurance agency. You don't have time to handwrite hundreds of prospecting letters.

Simply Noted can help. We can generate hundreds or thousands of handwritten mailers using our automated handwriting machines. They use real ballpoint pens for an authentic look and feel. We mail them for you, too.

Leverage Social Media

LinkedIn is the best social platform for building a business, but the others are useful as well. Millennials particularly use sites like Facebook, Instagram, Twitter, and YouTube to interact with the brands they like and seek advice on pressing questions.

Establish yourself on these platforms as a trusted source of information, help, and counsel. Make sure to post relevant articles, helpful advice, and other tidbits of interest to your target markets. Respond quickly to questions and always be forthcoming with useful lessons and pointers. Life insurance agents or any sort of insurance professional can benefit from becoming an authority.

Join relevant groups and become someone that other members turn to for guidance. You don’t want to make a hard sell here, and you don’t need to. When people see you as an authority that’s open and friendly, they’ll come to you with business.

It takes some time to establish yourself on multiple platforms, but the effort will pay dividends in the long run.

SEE ALSO: 10 REASONS YOU SHOULD SEND MORE HANDWRITTEN LETTERS

Use Pay Per Click Advertising

PPC or pay per click advertising is a cost-effective way to drive traffic to your website and fill your funnel with leads. There are a number of services that you can advertise with, including Google, Facebook, LinkedIn, Pinterest, and more.

The benefit of PPC is that you only pay when someone clicks on your ad. This is a far cry from the old days, when you paid a set amount for a Yellow Pages ad or a radio commercial, whether it generated business for you or not.

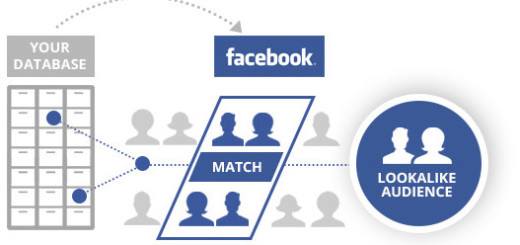

Further, PPC allows highly targeted ads. You can zero in on specific demographic information like age, interests, purchase history, geographic area, and more. This lets you market specifically to the types of people most likely to be interested in the insurance you sell, further amplifying the power of your ad dollars. Whether you're a life insurance agent, auto, home, or other, PPC can help you find your audience. Or, you can define it yourself with Facebook Lookalike Audience.

SEE ALSO: 10 SALES TIPS FOR NEW INSURANCE AGENTS

Facebook Lookalike Audience

This is a novel service offered by the social media giant that helps you find more customers like your existing customers. You feed it the names and contact information of a block of your current clients. It finds their accounts, analyzes their accumulated personal data, and then creates an amalgam profile that you can market to. This is extremely useful when you're not sure who to target with your ads. Facebook's algorithms can figure it out for you!

SEE ALSO: 10 THANK YOU LETTER TEMPLATES FOR REAL ESTATE AGENTS

Hang in There!

The unfortunate truth is that most new insurance agents fail. But that’s often because they don’t understand that you have to put in the time early on building a network, establishing your reputation, and laying the groundwork for later success. The early years are lean, but if you follow some of the advice in this article, and stick with it, you can create a successful career. Just keep at it!